http://www.insuringky.com

Welcome to

Thank you for choosing us for your insurance needs! It is our commitment to provide our clients with quality insurance products at a great price, and we are so pleased to have you as a new customer! As you may have already discovered, we offer real-time quotes on our website, payments over the phone, and E-signature options for most documents. Did you know you can also print ID Cards directly from our website? Of course, we always enjoy meeting and seeing our customers face to face! However, we understand your time is valuable, so we offer electronic options, as well as two office locations in order to accommodate your schedule. We have expanded our service team, as well, and look forward to helping you protect what is valuable to you!

OUR SERVICE TEAM:

6287 Taylorsville Rd.             1085 Eagle Lake Drive

Fisherville, KY  40023           Lawrenceburg, KY  40342

PHONE: (502)410-5089

PHONE: (502)410-5089

Jordan Milburn, ext. 105                                                                                                                                     Jessica Coleman, ext. 120

Licensed Service Specialist                                                                                                                                   Director of Client Services

CLIENT LIAISON                                                                                                                                              ACCOUNT EXECUTIVE

jordan.milburn@truepointgroup.com                                                                                                               jessica.coleman@truepointgroup.com

Jordan will likely be your first point of contact when you call. She is a licensed P&C Agent, and her primary responsibility is to ensure your satisfaction. From providing proof of insurance, taking payments, and processing policy changes to quoting/issuing new policies, she can often handle your requests quickly and efficiently (or direct you to the most effective resource available).

Jessica will be in the Lawrenceburg office from 8:30-4:30, M-F. She will coordinate with Jordan to ensure our agency is meeting the needs of our clients. As the Director of Client Services, she will be happy to review your policy at each renewal, and make sure you are receiving all of the discounts and coverage options available to you. You can call or email her to schedule your personal policy review. Also, if things change in your life (and they usually do), don’t forget to call and tell us! We want to keep you covered correctly! And if the worst should happen, and you need to file a claim, Jessica will gladly help you through the filing process for the quickest resolution possible.

They are both committed to giving you amazing service, and looking forward to working with you.

Please let us know if you have any questions about your new policy, or if you would like for us to quote another type of insurance for you. We appreciate your business!

Sincerely,

Brad and Kristen Smith

P.S. If you are happy with your service, Like, Share, or Leave a Review!  We’d love to hear your thoughts!

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions

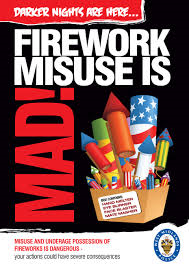

to property. Such losses can have substantial financial consequences, so it’s important to know whether you are insured in the event you cause a fireworks accident.

to property. Such losses can have substantial financial consequences, so it’s important to know whether you are insured in the event you cause a fireworks accident.

treatment could be handled under the Medical Payments portion. However, if the child’s injuries are more serious and her parents sue, your policy’s liability portion should handle your legal defense as well as a legal judgment.

treatment could be handled under the Medical Payments portion. However, if the child’s injuries are more serious and her parents sue, your policy’s liability portion should handle your legal defense as well as a legal judgment.

In order to drive a motorcycle in Kentucky, you must have at least the minimum of $10,000 damage per accident, $25,000 bodily injury liability per accident, and $50,000 for all bodily injuries per accident. This is only the minimum coverage and will only cover damages and injuries to other people. It also means you aren’t getting any financial protection for yourself in the event of an accident.

In order to drive a motorcycle in Kentucky, you must have at least the minimum of $10,000 damage per accident, $25,000 bodily injury liability per accident, and $50,000 for all bodily injuries per accident. This is only the minimum coverage and will only cover damages and injuries to other people. It also means you aren’t getting any financial protection for yourself in the event of an accident. At one time golf carts were seen exclusively on golf courses. Then, since golfing is part of the sports world, other sports saw their usefulness, so carts popped up along the sidelines of football fields and near baseball dugouts, shuttling players about. Today, many more people are aware of the non-sports usefulness of golf carts…..and that is becoming a problem.

At one time golf carts were seen exclusively on golf courses. Then, since golfing is part of the sports world, other sports saw their usefulness, so carts popped up along the sidelines of football fields and near baseball dugouts, shuttling players about. Today, many more people are aware of the non-sports usefulness of golf carts…..and that is becoming a problem.

tremendous difference being in an accident on a grass surface as opposed to an asphalt, gravel, packed-dirt or cement road. Some accident statistics reveal that golf cart accidents often involve children who are hurt when flung from carts during turns.

tremendous difference being in an accident on a grass surface as opposed to an asphalt, gravel, packed-dirt or cement road. Some accident statistics reveal that golf cart accidents often involve children who are hurt when flung from carts during turns.

PHONE: (502)410-5089

PHONE: (502)410-5089