What color is your umbrella? In today’s world, when it comes time to buy insurance, you will find that you have a range of options. The challenge is learning to optimize them to meet your own unique constraints and objectives. Individuals and businesses seeking Kentucky Insurance need to develop a thorough understanding of their insurance options.

Kentucky Insurance Markets:

For decades insurance markets were divided into two categories; Independent and Captive Insurance companies. The independent marketing channel is made up of agents (more accurately, Brokers) that represent multiple insurance companies. Captive carriers utilize agents or employees to distribute their products. This group tends to use more print, television, radio, newspaper and other to generate sales.

In recent years a third market has entered the mix; Direct Carriers. This group has many similarities to the Captive Carriers. The two groups have market plans that look very similar. The Direct Channel takes a much more aggressive approach regards utilizing online resources. The Direct sector of the market not only uses extensive online marketing, but many in this sector also have willingly foregone brick and mortar in favor of online facilities. In many instances, they have shifted the role of the agent to the customer’s computer keyboard.

When it comes to Property and Casualty insurance for

individuals, US Captive Carriers remain the largest player. The market share for Independent Insurance

companies has held fairly steady in recent years, during a time where the

Direct writers are rapidly gaining market share mostly at the expense of the Captive

market.

2017 Personal Lines US Market Share (Auto Insurance, Home Insurance,

and other)

Captive 46.6%

Independent 35.1%

Direct 18.3%

For businesses, the landscape is totally different. Independent Carriers have and continue to dominate this market. It doesn’t seem to difficult, with an 84% market share for US commercial insurance, it seems only logical that all business owners should consider quoting with at least one broker. But why?

Independent agents have access to more markets. More markets should mean better prices and in this case, it certainly does. Business owners are often willing to spend a little more time and put in a little more effort. The point is simple. If their competitor is able to secure insurance at a better value, they will be more competitive. Certainly a position no business owners wants to find himself in!

2017 Commercial Lines US Market Share (Business Insurance)

Captive 16%

Independent 84%

Direct <

1%

Overall the Independent Insurance leads the way, writing nearly 82% more US Property and Casualty insurance than the number two insurance company category, the Captive Carriers.

2017 Combined US Market Share (All Property and Casualty Insurance)

Captive 31.9%

Independent 58.1%

Direct 9.9%

What type of insurance carrier is

right for me?

There is no

right answer for everyone. But if you

are embarking on a search for cheap insurance in Kentucky, you might consider

reviewing the questions below:

- Will you be looking Kentucky business

insurance quotes?

- As

we noted earlier, Independent Insurance Agents write far more insurance than

the other two types of insurance companies combined. There is a reason this is happening, if you’re

looking for the cheapest insurance chances are you will find it here.

- Don’t

just get a commercial insurance quote, while you’re working with your Kentucky

Independent Insurance Agent, have them quote your home and auto insurance. Doing so my end with a lower premium on both

your commercial insurance and your home and car insurance. TAKE ADVANATAGE OF DISCOUNTS EVERY CHANCE YOU

GET.

Business

owners, that don’t get a commercial insurance quote from an Independent Insurance

Agent, are a favorite to pay a higher insurance premium than your

competition.

- Do you think the cheapest insurance

is the best insurance?

- Price

is important! It’s very important, but

it should never be your only consideration when buying insurance. It doesn’t matter whether you are searching

for household insurance, or for your business.

There are several issues you will want to explore:

- Deductibles-Be Extremely cautious if

it is percentage (i.e. 1-2%) instead of a dollar amount (i.e. $1,000)

- Replacement cost or Actual Cash Value

- Standard/Excluded Coverages – Your homeowner’s

insurance policy will exclude many items that you should be given the

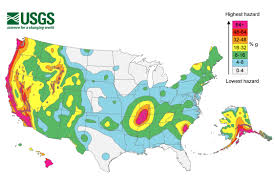

opportunity to consider: Earthquake

insurance, sinkhole insurance and many others

- Do you understand your business

insurance policy? There are many moving

parts, any of which could spell the end of your business if not properly

addressed.

None

of three insurance marketing venues has a hold on Cheap Insurance. Your personal financial situation, loss

history, age, location along with many other factors will all come into play in

determining your insurance premium.

We

advise our clients to think in terms of the best relative value. Most of us have a job and commute to and from

work four or five times a week. Would you

consider buying a bicycle to provide you transportation to and from your

work?

For

those that live a very short distance from work, this might be a viable

option. For several years I worked

within 2 miles of my home. During this

period, a bicycle would appear to have been a cheap option. I could have saved $10,000, $20,000, even

more had I taken the bicycle route.

That

would certainly be a great relative value if I lived in Gainesville

Florida. But what if I live in

Fairbanks, Alaska, where the average high temperature from November 1st

through March 31st is 10 degrees Fahrenheit? The bike would not be a wise choose.

When

I ask clients to focus on the best relative value, I am asking them to spend a

little more time to review policies. Sometimes

the best insurance policy actual is offered at the lower price or at a premium

that is so competitive that the only logical choice is to pay a little more for

the insurance policy that best fits the client’s needs. Most of us would gladly spend an extra

$20,000 to avoid commuting by bike in Fairbanks, Alaska

Insights

The Commercial Insurance market is extremely dependent

on the Independent Insurance Agency Network.

This group has access to more markets, better options, and overall

better pricing. We highly advise all Kentucky

Business Owners to seek the assistance of an Independent Insurance Agent.

Where can I get lowest cost insurance? Best Relative Value?

No one has a hold on Cheap Insurance. Independent and Captive markets provide consumer’s access to Knowledgeable Agents and more specifically, knowledge of Kentucky Insurance.

At the end of the day, we believe that it’s that independent insurance broker. There we believe you will more often find the end of your rainbow.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions

When you buy a home whether it is your first home or forever home, it is a major investment. For most families, it is the largest investment they will ever make. It needs to be protected so that you will always have a roof over your head, a place to call home. If your house is destroyed in a fire or other disaster, you want to be sure that you will be able to rebuild, to replace what you had before it was destroyed.

When you buy a home whether it is your first home or forever home, it is a major investment. For most families, it is the largest investment they will ever make. It needs to be protected so that you will always have a roof over your head, a place to call home. If your house is destroyed in a fire or other disaster, you want to be sure that you will be able to rebuild, to replace what you had before it was destroyed.