Liability coverage is insurance that protects the policyholder against accidents or damages. This article explains how this type of coverage can safeguard homeowners and business owners.

Understanding Liability Coverage

Liability coverage shields the policyholder from accidents that result in bodily injury or property damage. These accidents can occur in a residential or commercial environment.

For a liability insurance claim to be valid, the reported incident must be classified as an accident. Liability coverage does not extend to intentional acts.

Benefits of Coverage

Property owners may not have the funds to cover extensive medical bills or repairs. A liability insurance policy is designed to cover these costs if another party sues an individual.

The policy payout can be used for healthcare expenses, legal fees, and any other costs the insured party must pay.

The Role of Inspection in Liability Insurance

If you’re considering liability insurance, an inspection process can help assess the risk of incidents that might lead to an insurance claim.

For example, if you own a business, you can arrange for an inspection of your premises. This inspection will identify any potential risks that could lead to injury or property damage.

If numerous risks are identified, adding a substantial amount of liability insurance to your existing policy might be beneficial.

Consulting with a TruePoint Insurance Agent

Contact one of our insurance agents in Pooler, GA. The agent will help you add liability coverage to your policy.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions

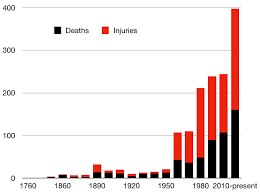

Tragedy is often the precursor of innovation. It certainly was during WW II. It also drives changes and the creation of new products in the insurance industry. The insurance sector exists because individuals, businesses and other entities have a need to transfer risks to another party. Increasing active shooter incidents in recent years and the corresponding legal actions have created demand for products that can provide financial protection.

Tragedy is often the precursor of innovation. It certainly was during WW II. It also drives changes and the creation of new products in the insurance industry. The insurance sector exists because individuals, businesses and other entities have a need to transfer risks to another party. Increasing active shooter incidents in recent years and the corresponding legal actions have created demand for products that can provide financial protection. industry will over time and after numerous assessments develop standards that when deployed will ward off many would be active shooters. They work for insurance companies will also work to reduce the after effects and of course provide financial relief.

industry will over time and after numerous assessments develop standards that when deployed will ward off many would be active shooters. They work for insurance companies will also work to reduce the after effects and of course provide financial relief.

In part one of this article, we discussed the situation of properly classifying workers. In this part, we discuss a method for making that distinction.

In part one of this article, we discussed the situation of properly classifying workers. In this part, we discuss a method for making that distinction. another element is the nature of the work. Some businesses want to minimize both their tax liability and legal liability (and related payroll costs) by use of independent contractors. However, the situation can’t be a façade. If workers have an ongoing relationship with the applicable business because the work is normal for that business, likely the work involves employees. When the work is unusual for the given business and lasts for a short period, especially when it involves specialize labor or skills not existing in that business, the work likely involves independent contractors.

another element is the nature of the work. Some businesses want to minimize both their tax liability and legal liability (and related payroll costs) by use of independent contractors. However, the situation can’t be a façade. If workers have an ongoing relationship with the applicable business because the work is normal for that business, likely the work involves employees. When the work is unusual for the given business and lasts for a short period, especially when it involves specialize labor or skills not existing in that business, the work likely involves independent contractors.

First, there is customer expectations. Insurance consumers may be under the impression that damage and injury created by shooters are covered. Second, the insurance market is fragmented over the issue depending upon how incidents are interpreted. Coverage may be sought from existing policies that individuals, commercial or non-profit entities may already carry, including General Liability, the Liability portion of Homeowners, or Workers Compensation. On the other hand, responsibility for harm due to a shooter may need to be covered by a form of professional liability policy as the obligation to protect against shootings may be considered as a failure to provide adequate security.

First, there is customer expectations. Insurance consumers may be under the impression that damage and injury created by shooters are covered. Second, the insurance market is fragmented over the issue depending upon how incidents are interpreted. Coverage may be sought from existing policies that individuals, commercial or non-profit entities may already carry, including General Liability, the Liability portion of Homeowners, or Workers Compensation. On the other hand, responsibility for harm due to a shooter may need to be covered by a form of professional liability policy as the obligation to protect against shootings may be considered as a failure to provide adequate security. Because of the position held by policyholder/insureds and insurance companies, the classification of workers is often in conflict as insureds desire liberal coverage and insurers wish to restrict protection to qualified persons. However, both parties are best served when worker classifications are clear. Premiums charged to policyholders are based on correctly recognizing the parties eligible for coverage. Proper classification keeps coverage affordable and makes the insurance process more efficient. Coverage involving employees should be connected to an applicable business that employs them. Coverage involving independent contractors should be connected to the contractors. In other words, they should secure their own, separate coverage.

Because of the position held by policyholder/insureds and insurance companies, the classification of workers is often in conflict as insureds desire liberal coverage and insurers wish to restrict protection to qualified persons. However, both parties are best served when worker classifications are clear. Premiums charged to policyholders are based on correctly recognizing the parties eligible for coverage. Proper classification keeps coverage affordable and makes the insurance process more efficient. Coverage involving employees should be connected to an applicable business that employs them. Coverage involving independent contractors should be connected to the contractors. In other words, they should secure their own, separate coverage. Insurers commonly provide coverage for mobile/manufactured homes by modifying a conventional homeowner policy with provisions called endorsements. The endorsements change key definitions and other elements of a conventional policy to fit a mobile or manufactured home situation. The result is a modified homeowner package that protects the home, outbuildings (unattached garages, sheds, etc.) and personal property. They also provide insurance for personal liability. Regardless of the type of home you own or live in,

Insurers commonly provide coverage for mobile/manufactured homes by modifying a conventional homeowner policy with provisions called endorsements. The endorsements change key definitions and other elements of a conventional policy to fit a mobile or manufactured home situation. The result is a modified homeowner package that protects the home, outbuildings (unattached garages, sheds, etc.) and personal property. They also provide insurance for personal liability. Regardless of the type of home you own or live in,  Any coverage option you choose is likely to reflect the fact that mobile homes are, well, mobile. Therefore coverage is affected by the fact that mobile homes:

Any coverage option you choose is likely to reflect the fact that mobile homes are, well, mobile. Therefore coverage is affected by the fact that mobile homes: