What is earthquake insurance?

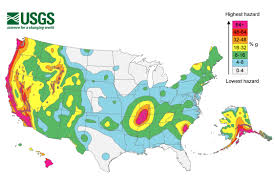

Earthquake: A term used to reference the movement of two tectonic plates along a fault line. The tectonic plates move past each other at a slow pace building up stress along the way. This continues until finally, the plates slip, releasing enormous amounts of seismic energy. This energy then results in a violent shaking of the ground. This is also referred to as an earthquake. Earthquakes can be the result of both tectonic action or volcanic.

Earthquake Insurance: Losses as a result of the movement of the earth are not covered by standard insurance policies. Earthquakes are one of the events that are considered the movement of earth. Most insurance professionals can help you reduce your exposure to earthquakes by adding a special endorsement to your policy.

Earthquake insurance, or more accurately an earthquake endorsement, is a tool that can be used to transfer the risk of a financial loss to buildings. Structures such as homes or commercial buildings can be protected from damages that are a direct result of an earthquake.

In exchange for an annual insurance premium, the insurance company promises to restore the insured to the position that existed immediately before the event(less a deductible). Deductibles for earthquake insurance can be significantly higher than other coverage options. As a result, we advise customers to review the deductible before purchasing an endorsement.

As mentioned, the movement of the earth comes in several forms. Earthquakes, mudslides, and sinkholes are just a few. Earthquake insurance covers earthquakes. It will not cover losses that are a result of other types of movement of earth.

If you would like additional insights call a TruePoint Agent today at (502) 410-5089

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions