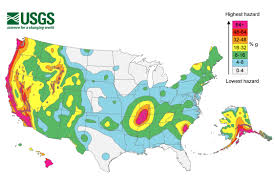

Most homeowners likely know that, regardless where they live, they may be exposed to a catastrophic loss such as flooding. It is definitely not restricted to coastal location. However, the same cannot be said concerning earthquakes. It is much more likely that only persons living in well-known earthquake areas (such as California and Alaska) have a high awareness of its danger.

However, the danger of earthquake exists in several large areas of the United States, including a significant part of the Midwest. The New Madrid fault line crosses much of the Midwest, making states such as Indiana, Ohio, Illinois, Ohio, Kentucky Tennessee and Missouri vulnerable to earthquake catastrophe (particularly the latter two states). In the last decade, regular activity has been measured in this Seismic Zone.

A recent development is affecting this source of loss. Though some questions remain, it appears that the widespread practice of obtaining natural gas via the process of hydraulic fracking may be triggering earthquakes in areas that had previously seen little to no quake activity.

While many persons may be exposed to the danger of earthquake, only a fraction of such property owners carry the proper level of insurance. Basic homeowner coverage does NOT include protection against earthquakes. Without purchasing specific earthquake insurance, the only protection available for a policyholder is against limited, consequential damage.

Example: The Johnsons love their home on the outskirts of Juneau. While they’ve experienced a number of minor earthquakes, in the few years they’ve owned the home: they did not buy earthquake coverage. One day a quake occurs and severely damages their home. The quake breaks a gas pipe and a fire erupts. The fire damage is covered (though the quake damage is not).

Earthquake coverage is typically quite affordable. It is generally available for a couple hundred dollars per year to provide protection for a modest-sized home. While, even in areas that are in earthquake prone, such losses are low probability; the potential loss severity is so high that purchasing separate protection makes sense. So shake up your insurance protection and avoid being totally shaken down by a disastrous quake!

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions