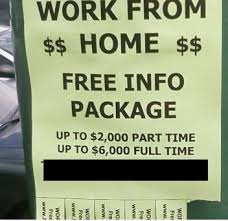

A variety of businesses are routinely operated in homes. This article discusses aspects of particular operations. Refer to Home Businesses – Basics for background information on coverage as well as our other articles discussing different in-home businesses.

Retail – Persons with in-home retail operations must look beyond an HO policy for coverage.

The Businessowners Policy (BOP) provides broad coverages for buildings, personal property, loss of business income and extra expenses incurred to remain in business (after a fire or other covered cause of loss), premises liability and medical payments. If you have more than $1,000 of goods in transit, you will need to add additional coverage. Goods stored at other locations must be added to the policy, normally as an additional location.

You will need workers compensation coverage for any employee, even part-timers. You may need commercial automobile insurance if you deliver anything or if your vehicle is larger than a car, van or small pickup or if the vehicle is owned by a corporation.

Note: some insurance companies can offer amendments to your homeowners policy that can cover certain, in-home businesses.

COPYRIGHT: Insurance Publishing Plus, Inc. 2016

All rights reserved. Production or distribution, whether in whole or in part, in any form of media or language; and no matter what country, state or territory, is expressly forbidden without written consent of Insurance Publishing Plus, Inc.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions