If you work from your home for part of your workweek and if the situation is an ongoing arrangement with your employer…that’s telecommuting! That is also an opportunity to make special insurance considerations. Consider the following:

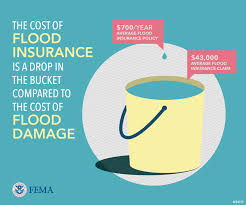

Property Considerations

You may have gaps in coverage because of your work arrangement. You may not have the insurance protection you need for your employer’s business property that is kept in your home or your own property that is used to perform your job. This is because residential insurance policies severely restrict or exclude coverage for business property. A further complication is that business property usually consists of high-valued items that are vulnerable to damage and/or to theft. Such property includes fax machines, copiers, computers, pads, smart phones, computer peripherals, GPS, etc.

Liability Considerations

Personal insurance policies that include liability protection typically exclude business-related losses. Further, different policies can be quite broad in interpreting how a loss is connected to “business.” Liability Policies A and B would routinely respond to handling an insured who spilled hot coffee on a guest in his home. What if, instead of being a social guest, the visitor was your employer’s client? Policy A may still offer coverage because it considers the coffee spill to be a common home hazard. Policy B, however, may flat-out exclude the loss because the injured person was in the home for a business reason.

Vehicle Liability

Instead of using your personal vehicle for going to and from work, more of your vehicle use may be related to your job, such as making deliveries, calling on clients or visiting jobsites. Many instances of job related use might be excluded from your personal auto coverage.

Home Accidents

Simple events may be complicated when they occur in the course of performing your job at home. Coverage for injuries suffered while going up the stairs or experiencing a prolonged illness may cause coverage questions for your employer. Individual company or state-mandated coverage for employees may not apply to work-related accidents that occur at home.

Document What You Do

In order to determine your coverage needs, you must clearly identify your exposure to business losses. Document the following:

- What routine job duties do you perform in your home?

- Are any tasks hazardous?

- Who visits your home because of your job (clients, vendors, repair personnel, suppliers, others)? Be Specific.

- How often do such persons visit?

- Is a certain part of your home dedicated as a work area/office?

- What equipment is used in your job? (Is the equipment used only for your job? Who owns each piece of equipment?)

Once you have a good idea of the loss exposures from performing your job at home, you need to discuss your situation with an insurance professional. An insurance pro can help you find additional coverage options as well as help to identify what coverage gaps must be addressed by your employer. While it can be liberating to telecommute, you must make sure that you haven’t given up important protection along with your cubicle or office.

COPYRIGHT: Insurance Publishing Plus, Inc. 2015

All rights reserved. Production or distribution, whether in whole or in part, in any form of media or language; and no matter what country, state or territory, is expressly forbidden without written consent of Insurance Publishing Plus, Inc.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions